In a typical organization, finance is one of the most important functions. Yet teams are often bogged down by manual workflows. According to a survey by Paylocity, an HR software provider, 38% of finance teams spend more than a fourth of their time on manual jobs, like reviewing invoices.

Matthieu Hafemeister, an ex-fintech investor at Andreessen Horowitz, says he’s seen many finance orgs struggle to scale up as a result of all the work they’re doing by hand.

“The status quo for finance is countless point solutions that are cobbled together within the finance department,” Hafemeister told TechCrunch. “Excel continues to be the lowest common denominator, limiting the promise of automation.”

To Hafemeister’s point, most finance departments are indeed heavily reliant on spreadsheets. One survey found that 82% still use Excel files for budgeting, forecasting, and other core financial planning activities.

After experiencing these frustrations firsthand while leading growth at fintech firm Jeeves, Hafemeister decided to team up with Ted Michaels, Jeeves’ previous head of finance and an old friend, to launch a platform to automate financial tasks.

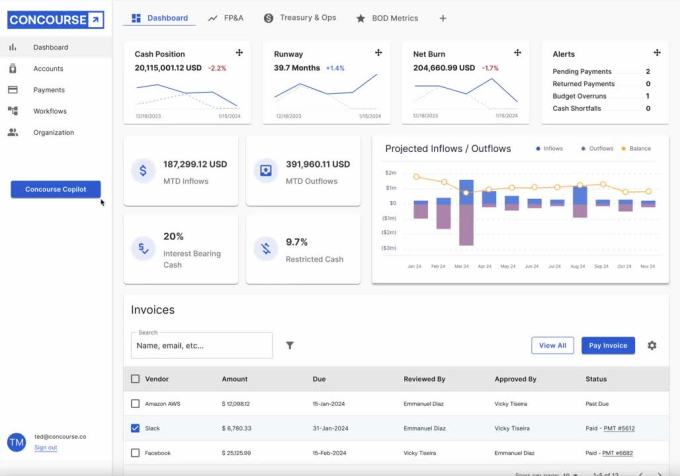

Called Concourse, the platform connects to a businesses’ financial systems to let finance teams retrieve and analyze data, generate charts, and ask ad-hoc questions such as “What’s our non-GAAP revenue?”

“Concourse can proactively surface insights that allow finance teams to be better prepared by enabling them to stay ahead of trends,” Hafemeister said. “Instead of a tool that tries to improve the speed or efficiency of completing a task, Concourse can be given discrete tasks to do entirely on its own.”

Now, finance automation isn’t exactly new technology. Linq recently emerged from stealth with AI to automate aspects of research for financial analysts. Ledge and Doopla are also building a range of finance-specific generative modeling tools.

But what makes Concourse different, according to Hafemeister, is its ability to execute financial workflows with “complex, multi-step operations.” For example, the platform can retrieve data from a company’s NetSuite dashboard to download CSV files, then copy that data to an Excel spreadsheet.

“We leverage large language models to do what they are best suited for and pair them with more traditional methods of data analysis,” Hafemeister explained.

There’s great interest in AI for finance. One poll found that 58% of finance teams are now using some form of AI technology, up 21% from 2023. Grand View Research estimates that the “AI in fintech” segment, worth $9.45 billion three years ago, is growing 16.5% annually.

But to stand a chance of making a dent in the market for finance automation tech, Concourse will have to demonstrate its product’s ROI — a challenging feat. Per Gartner, showing or estimating the value of AI is a top barrier to adopting it for close to half of companies.

Concourse will also have to assuage potential customers’ fears of AI-introduced errors and hallucinations. In a poll of U.K.-based executives by HR specialist Peninsula, 40% said inaccuracies from AI tools were a key concern, followed by concerns around data confidentiality.

Hafemeister said that Concourse employs “a variety of tools and techniques” for fact-checking and validation to try to ensure its AI performs tasks as intended. He added that Concourse doesn’t use companies’ data to train its AI models — at least not without explicit permission — and that the platform only collects data customers share with it.

“Data accuracy is paramount in finance, where answers are typically either entirely correct or entirely incorrect,” Hafemeister said. “As such, at Concourse we’ve spent a lot of time and effort on delivering AI that can accurately perform the task it’s been assigned. We also take data privacy and security very seriously, and have built Concourse using industry best practices.”

Folks seem willing to be take Hafemeister at his word.

Concourse, which is still in beta ahead of a broader launch planned for next year, has several customers, including Instabase and Shef, and $4.7 million in capital. Hafemeister’s ex-employer, a16z, has invested in the startup, along with Y Combinator, CRV, and Box Group.

Hafemeister says the focus at the moment is product development and growing New York-based Concourse’s six-person staff.

“We raised money to hire more engineers, build out more workflows that our AI can take on, increase coverage on data integrations, and start to scale our go-to-market function,” he said. “The strong focus on engineering recruiting is to hire backend, machine learning, and AI engineers.”

Leave a Reply