Amnon Shashua, the founder and CEO of Mobileye, has an eye for complicated problems that he believes can be solved with AI, and that AI itself can be fixed to become more reliable. On the sidelines of building and running his self-driving car technology company — which he took public, then sold to Intel, then spun out again — he’s been hatching a number of other ideas.

Now, one of these is raising money and gaining significant momentum.

One Zero, a fintech aiming to use AI in retail banking services, is in the process of raising at least $100 million, TechCrunch has learned.

Despite being co-founded by one of the most high-profile and successful founders in Israel, One Zero has had surprisingly little attention to date outside of its home market. But the company has raised around $242 million so far, and in 2023 it was valued at $320 million, per data in PitchBook. Our sources say that the valuation will be significantly higher in the next round.

It is unclear who the investors are, but previous backers of the company include Tencent, OurCrowd, and SBI Ventures (the now-independent firm that once was a part of SoftBank).

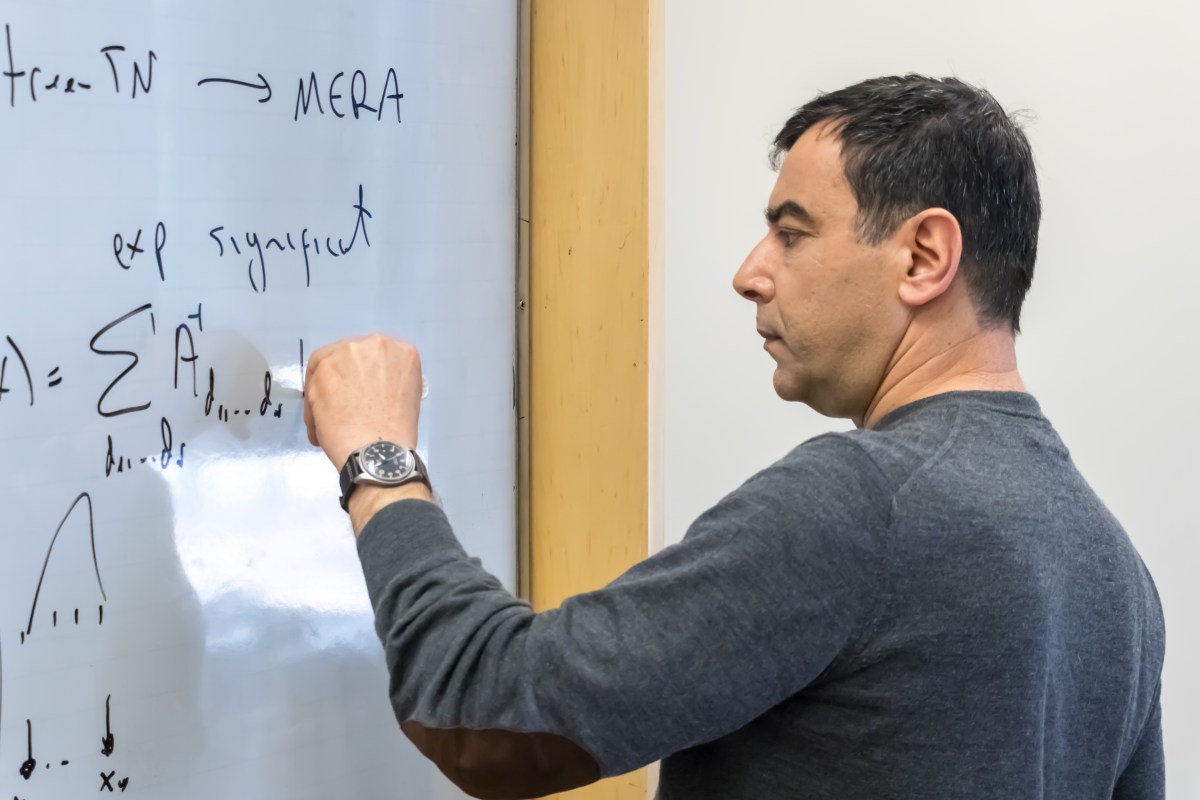

One Zero’s momentum comes amid a frenetic pace of activity for Shashua, who has a non-executive role at the company, with Gal Bar Dea as CEO. In the last couple of years, Shashua has founded or co-founded startups working on humanoid robotics (Mentee) and alternative approaches to large language models for generative AI (AI21), as well as, launched only a couple of weeks ago, AA-I Technologies (pronounced “double AI”), which Shashua describes as his effort to build an “AI scientist. He is also a computer science professor at the Hebrew University in Jerusalem.

One Zero’s equally ambitious mission is to “bring private banking to the masses,” he said in an interview. It aims to democratize the kind of high-touch, advisory-type services that high-net-worth individuals get when they bank, in a market where the average person not only doesn’t get that kind of service today, but is staring at a future where there may be no physical bank, and no humans to help, at all.

It’s tackling that ambition by way of a double business focus. In Israel, where One Zero is based, the startup has acquired a banking license and has been building a full-stack retail bank. Alongside this, One Zero is using insights gained from that retail business — which Shashua described in an interview as a “sandbox” — to train its models and hone its technology in order to license that tech to banks operating elsewhere.

The retail business now has around 110,000 customers, Shashua told TechCrunch, and although it has yet to announce any licensing deals so far, the company says it’s received a number of inbound requests from major banks to do so.

The company’s cornerstone so far — and the focus of where it plans to invest its funding — is a chatbot called Ella, which aims to be better than current chatbots while providing services that human bankers could not.

As Shashua sees it, while there have been a number of efforts to build AI into retail banking services, for example around functions like managing spending, they’re limited in what they can do.

“You don’t see banks deploying artificial intelligence to a level in which you are actually replacing a banker,” he said.

As an example, he said, take automated communication. You can ask a banking chatbot very basic questions, such as “how much money is in my account?,” or information about recent transactions, and it can usually answer. But it’s a different story if you ask anything with calculations, such as “how much money will I have in my deposit account at the end of the year based on activity so far?”, or “what is the best way for me to buy a car based on my financial profile?” Not only are chatbots incapable of answering such questions, most personal bankers can’t either.

“There is an opportunity here, where generative AI can, seemingly, do this,” he said. “It goes way beyond spending tracking.”

One Zero’s approach to building such an AI, as Shashua described it, is very ambitious and feels as tricky as self-driving. It focuses on using multiple large language models. Some models may be optimized for different tasks, he said, but running tasks through several LLMs can also provide a diversity of responses, which then are run through a verification process to understand when answers are misleading or wrong.

And if those answers are not verified to be helpful or correct, the AI doesn’t attempt to say something anyway, he said. “It’s okay [for it to] say, I cannot solve your problem. I cannot answer your question,” he said. “Humans also cannot answer every question, right? So it’s okay. It’s not okay to say, here’s an answer to your question, and the answer is completely fake, completely false.”

The system is starting with more basic tasks like spending management and the plan is to add in more functionality over time to help advise customers on financing big purchases or saving money more wisely.

Leave a Reply